BD is tough

Not any more! Keep track of all outbound and inbound referrals, track your best sources and business generators with your subscription.

Premium

Premium

Analytics and insights

See where your deals are coming from and going to and who your top performers are.

Peer benchmarks

Understand how you compare to your peers and how you can improve.

THE CRM of deals

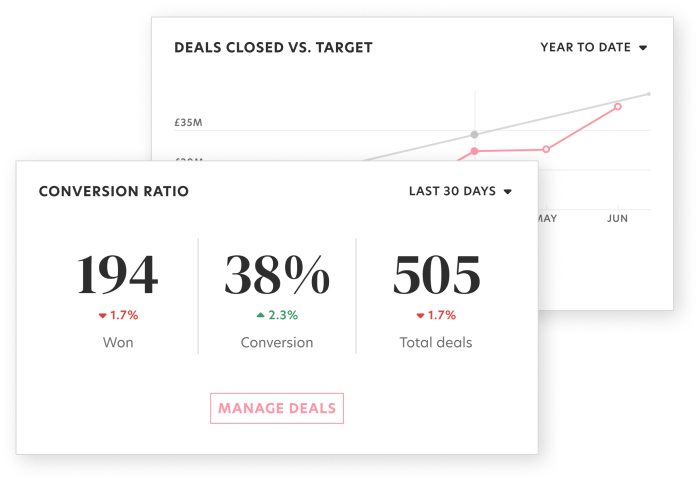

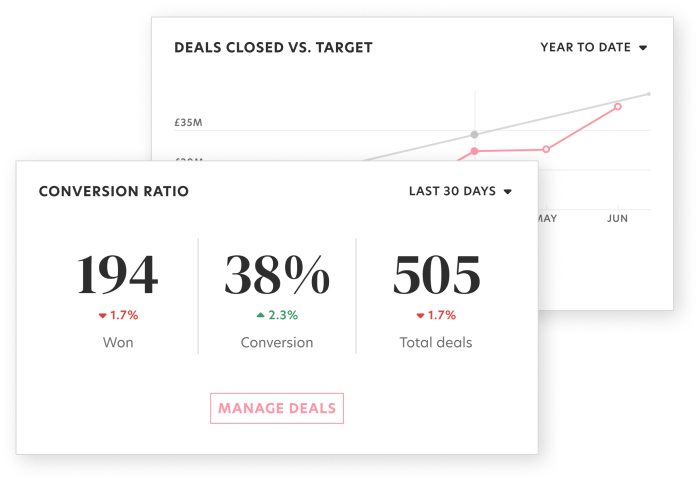

Track your conversion ratio. Set and measure your target deal closure.

Record of events

Move your employee's referral activity off WhatsApp and onto one platform.

Analytics and insights

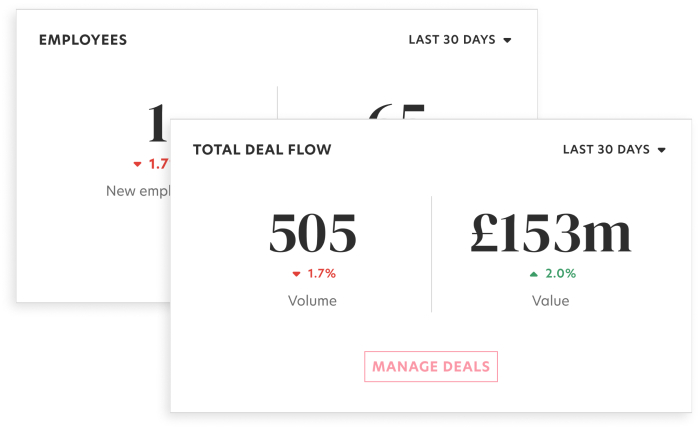

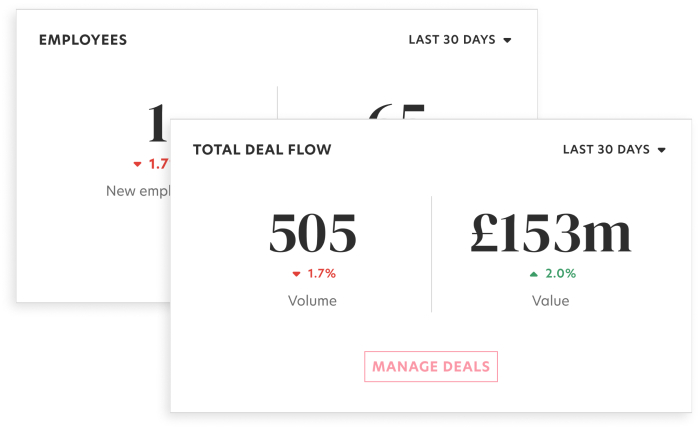

Dashboards for the Board

Get up to the minute cross-organisational analytics and insights on where your deals are coming from and going to. Understand your conversion ratio and how your employees are performing.

Peer benchmarks

Know your apples from your pears

Understand your strengths and weaknesses when comparing yourself to your peers and get actionable insights on how to improve.

The CRM of deals

Data flows for deal flows

Mange your pipeline, see threats to open deals and see who your top referring organisations are by value and by volume.

Reduce litigation

Off the record on the record

Capture key data relating to RDR, MiFID, GDPR, AB&C and Commission Disclosures in one click with an on-the-record tender process.

All paid plans include

Priority access

Priority access to early deal flow, report designs, and promotion.

Auto-verification

Increase your chances of receiving invites to opportunities with auto-verification for employees.

Access to membership

Broadcast your company insights and case studies to membership

Enterprise data

Data across all business units across all territories.

Premium

Wealth expertise, connected

Join our global community of trusted professional advisors

Family offices and leading professionals across the wealth industry

4,000+

Professionals£400m+

Deal flowWhat members say about STAK

Frequently asked questions

STAK is free for individual professional members and Family Offices. Organisations pay a subscription for premium features and access to data about their activities.

Organisation subscribers pricing is simple: small (<10) organisations can manage their activity without subscribing; other organisations can subscribe per business unit at £500 per month, with additional business units/ administrators costing the same (£500 per month per user). Underlying members (employees) are free to use the platform. Pricing is subject to change for new subscribers and based on demand levels/ popularity. Discounts available for annual payment up front and large scale organisations.

Subscribing to STAK provides your organisation with premium features including MI on organisational member activity; access to administrator roles (typically your Business Development role) allowing you to tender for opportunities as an organisation and also manage your organisation profile, appetite statement and specialisms for new opportunities. Subscribers also get opportunities to contribute content for other members to view.

STAK is fundamentally a tool for business development and referral management in the wealth sector. A Universal CRM and opportunities hub in one site.

The membership is made up entirely of verified wealth professionals from across all specialisms, representing their clients in the search for opportunities and services. Buy, sell, or source services in an efficient way using a single tool, with pre-prepared templates for tender process built by industry experts. All opportunities are trusted scenarios until a winner is selected, at which point deals are undertaken off platform by the expert (you). We never knowingly hold client identities (you use your internal reference) and we never disclose your identity without your authority.

Do you know, with confidence, who your primary sources of business are, whether you are beating the competition on mandates, and why, what share of the market you are capturing, and what your key differentiators are when promoting your product?

STAK is particularly powerful for managing direct referrals or competitive tenders, where we have designed intelligent forms for each major wealth service, and capturing a reconciled record of your organisation's outward referrals for services to your clients, also a record of inward referrals from third parties. The tool is also incredibly powerful as a way of managing, on the record, circumstances such as reverse-solicitation and legitimate cross-border enquiries. National authorities are becoming increasingly protective of marketing practices for sale of funds, investment services, and other products and services across their borders.

Relationships will never, in our view, be replaced or compromised by tech like STAK. Our ambition is to provide a broader market for opportunities, and shorter lines of discovery, without ever compromising the role of the professional leading the relationship. By all means leverage your network or return a favour, but surely it is just smart to capture your referrals on a central ledger, and show your relationships, and the wider market, how valuable you are as a source of business and opportunity?

Private Clients are incredibly hungry for new alternative investments and will always ask your employees, their trusted adviser, for a lead, guidance or support for their search - why limit to your personal network when you have thousands of verified professionals at your fingertips? And in the difficult event of a contentious client situation, how powerful is it to have your referral and actions entirely on the record?

Our membership is made up of active family offices, verified professionals in every field of the wealth industry, and under a different category we welcome specialist brokers who help to complete difficult or highly specialised transactions.

STAK is highly attractive to family offices and private investment structures for UHNW's, because they crave both opportunity and privacy. The platform allows them to search directly for opportunities or providers by disclosing their profile bt not their identity, until a chosen provider is appointed. STAK is also incredibly popular with sellside, those who wish to dispose of an asset or raise funds for venture, whether for co-investment or outright sale, without any risk of connecting with retail investors. Finally, individual professionals, whether they be employees of large firms or specialist independents, always struggle to reach a wide market or to differentiate their services: STAK provides a full market reach to all, a true meritocracy.

No, you are always in control of your data as an organisation however we do surface comparative data such as pricing outcomes when you lose tenders (RFP's) or summary data on your employee member activity and success factors. Where you add employees to the platform (in bulk or individually) you have dual control of their data and retain their track record if they leave your employment. If your employees join independent of your subscription or invitation they are in control of what level of information you can see, albeit track record is still always attributable to your organisation.

Our mantra is 'reciprocity makes the world go round'. Follow your usual practice of referring opportunities but use STA for the direct referral or tender process: this presents your value creation and activity to the recipient but also the wider world. It is so powerful to be able to articulate to partners and clients the value and reach you have as a business. We strongly recommend that you invite active, client-facing colleagues to join the platform and motivate them to manage their referrals and opportunities for your clients, which you cannot provide solutions for, via STAK. We will help you onboard in bulk if necessary and provide training and tips to your team in the process.

The UHNW community of growing at a steady 9% compounded Year-on-Year and new generation actors do not follow conventional channels for sourcing skilled investment managers. They use technology, do their research, understand where they want their assets held, and are globally mobile and agile in their activities. Ensure your proposition are presented on STAK is specialised and regionally focused, focusing on your true differentiators, and STAK and the STAK community will naturally find your business either through Nomination (a key feature of our platform) or using our technology to refine a search based on match criteria. We do not undertake suitability assessments for clients of our members, however we do provide you with complex, relevant information in the tender process that gives you sufficient information to respond with your proposal. Our tender process guides the searcher, helping them to provide information that is relevant to your decision making process in terms of country risk, AML consideration (SoW/ SoF), broad attitude to risk, total wealth available for investment and investment ambitions. We do not present performance criteria: that is for you to provide upon shortlisting or selection.

Trustees for the most part are incredibly close to the long term wishes and sentiment of their client/ beneficiaries, and are often accountable for decisions made regarding selection of providers, opportunities, services. Beneficiaries and Settlors can often put pressure on a Trustee to select preferred providers due to family connections or favours due: STAK puts such matters in the record and allows the Trustee to either allow their client to nominate a party (on the record, where they accept the nomination) or run a tender process including relevant third parties. Trustees are also often in a position to search for new lenders, bankers, investment managers, lawyers and insurance providers, or to find an alternative providers for Protector roles, PTC, or other services due to conflicts or exit considerations. Again, STAK puts this process on the record, transparent, and we have established workflows that demystify the search and selection process.

Legal advisers are not only incredibly close to their client affairs, they are also in an enviable position to present opportunities to third parties due to transactional requirements or long term structures/ services. A law firm is always pleased to see a particular partner or associate thrive in building their own network, however the firm will always prefer to have visibility over that network, the performance and leverage held by their employees, and the ability to retain that leverage for the firm, not the employee. Lawfirms can use STAK to manage the referral process, provide their employees with freedom to undertake their activities and leverage their network, but protect the long term interest of the firm through ensuring the activities are represented firm-wide rather than at individual level. Lawfirms also struggle to differentiate between fee earners in their stricture, resulting in talented associates, where they are bread-winners leaving through lack of recognition or because a partner or senior reaps the rewards of their activities. It is undoubtedly important for successful firms to understand their source of best relationships, referrals, and value in order to reward the right people.

Do you understand the short term drivers of your success or failure in the lending markets in which you operate? Where is your source of information on whether your bank account proposition or deposit pricing is 'on market'? Are you depending on brokers and intermediaries for your lending opportunities, and of so do you understand, with rich data, who your most valuable, reliable referral sources are? Are your bankers faced with situations where their long term most valued clients are asking for assistance from their trusted adviser on other maker eg tax, insurance, custody, investment that you may not be able to provide? You have a choice: tell your bankers to say no, leave them with a choice to quietly recommend a friend/ former colleague, or provide them with a facility to refer the opportunity, on the record and with the clients recorded consent, onward to a third party, without fees or compensation. Your reputation as a source of new business and a channel for wider solutions will only strengthen your relationships with your clients, rather than leave them out in the cold, speaking to competitors and their promises.

Join today to source services, refer leads and find opportunities

Signing up takes seconds and, once verified, get alerts on new deals or invite or nominate colleagues & trusted contacts to tender